Everything You Need to Know About Bonus Depreciation Eligibility

Time is running out for 100% bonus depreciation on your next private jet.

Since the Tax Cuts & Jobs Act (TCJA) was introduced in 2017, private jet owners have enjoyed 100% bonus depreciation on their assets. However, this advantage comes to an end in 2022 and will be phased down thereafter. The TCJA created incredible opportunity for prospective aircraft owners. When considering the complex process of aircraft acquisition, in the future or to capture 100% bonus depreciation now, there remain many important factors need careful consideration.

The way you manage the purchase of your aircraft is important to optimizing your potential tax advantages, especially heading into 2023 and beyond. With the window of eligibility for 100% bonus depreciation drawing to a rapid close, here’s what you need to know if you plan on acquiring a private jet before December 31, 2022.

What Is Bonus Depreciation, and What Does It Mean for Potential Aircraft Owners?

Standard depreciation occurs when a business purchases an asset such as a private jet and the cost is written off gradually over the course of its useful lifetime. On the other hand, bonus depreciation occurs when a large percentage (up to 100%) of an asset is written off within the year of acquisition. In plainer terms, bonus depreciation allows for quicker depreciation of an asset.

Before 2017, only brand-new aircraft qualified for bonus depreciation, but TCJA allows the same benefit for preowned aircraft. This change created huge opportunity for business aviation users of all shapes and sizes. Deducting $50,000 per year may not impact a given year’s taxable income but deducting $500,000 within a single year can significantly reduce a taxpayer’s highest marginal tax rate.

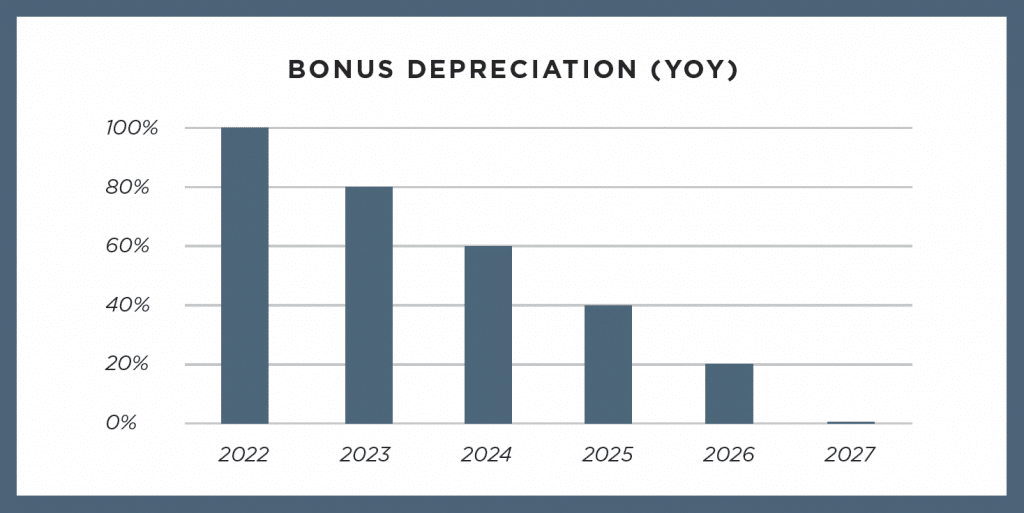

Due to a provision in TCJA, bonus depreciation has been allowed for 100% of the cost of qualifying property (including new or preowned private jets) through the end of 2022. Beginning in 2023, a phasedown in bonus depreciation percentage will drop by 20 percentage points each year. As a rule, under I.R.C. § 168(k)(6) an aircraft placed in service in 2023 will be eligible for 80% bonus depreciation, and in 2024 would be eligible for 60% bonus depreciation and so on until 2027 when benefits phase out completely at 0%.

If you’re thinking of purchasing an aircraft and want to benefit from bonus depreciation, right now is the time to begin speaking with a qualified Acquisitions & Sales team and structuring ownership for optimized tax benefits.

Who Can Benefit from Bonus Depreciation?

A wide variety of other assets considered “qualified property” can benefit from bonus depreciation, including depreciable assets such as heavy machinery, vehicles, computer software, and even furniture. Companies and individuals looking to protect taxable income can benefit greatly from bonus depreciation, whether that comes from purchasing a bulldozer or a private jet.

For aircraft to qualify for 100% bonus depreciation, the asset must be purchased and placed in service for an active business in the tax year in question and must be used at least 25% of the time for “qualified business use,” and at least 51% of the time for total business use.

Another important key to eligibility is that qualified property is placed into service prior to the 2023 deadline. This means it’s not enough to purchase the qualified property and reap the tax benefits, the asset must be in service yet this year (the same will be true in years ahead). As we approach the close of the fourth quarter of 2022, the focus should be to close deals and place assets in service before the end of the year. If this isn’t a plausible timeline, the next best thing would be to calculate bonus depreciation with the 80% figure for 2023.

Keep in mind that complex IRS regulations may curtail eligibility for bonus depreciation, which is why a proper ownership structure needs to consider FAA rules, state sales and use tax. The Jet Linx Acquisitions & Sales team always consults professional aircraft tax consultants when working with clients to determine the most feasible solution.

When Does Bonus Depreciation Expire and When Does the Benefit Change?

The benefit of 100% bonus depreciation (in most circumstances – there are exceptions between new and preowned aircraft) will end on December 31, 2022. In 2023, bonus depreciation for preowned aircraft will fall to 80%; 2024 will be 60%; 2025 will be 40%; 2026 will be 20%; 2027 will drop to 0%. While 80% bonus depreciation is still beneficial, that small 20% drop can still impact your annual tax payout.

However, if a taxpayer signs a binding contract to purchase a new business aircraft before December 31, 2023, they are still allowed 100% bonus depreciation in 2023 with a rollback for bonus depreciation on new aircraft purchases at 80% in 2024, 60% in 2025, 40% in 2026, 20% in 2027 and 0% in 2028. New aircraft acquisition can qualify for the reprieve on bonus depreciation phase out if certain requirements are met:

- The purchase must be a new aircraft or a demonstrator

- Aircraft use is non-commercial

- Production period of the aircraft is greater than four months

- Purchaser must sign a written, binding contract with a nonrefundable deposit of at least $100,000

- For delivery in 2023, the binding contract must be executed before December 31, 2022

- For delivery in 2024, the binding contract must be executed before December 31, 2023

Prospective aircraft buyers should have little trouble meeting these requirements but should be careful to preserve and document all written contracts, while working closely with aircraft tax consultants and private jet Acquisitions & Sales specialists. Few tax professionals would be comfortable making predictions on what may happen with bonus depreciation in the future, especially with talk of tax reform. The best option for prospective aircraft owners is to continue to take robust depreciation allowed by current law.

Why Does Bonus Depreciation Matter for Aircraft Owners?

A new private jet purchased for $15 million and placed in service this year would protect $15 million of income from taxation, and with a 37% tax rate, that’s $5.5 million in taxes that individuals won’t owe.

Another benefit of bonus depreciation comes from the fact that taxpayers also write off more than they usually would, significantly reducing tax rate no matter the usage on the aircraft. If an aircraft is acquired in late 2022, enters service and is used for 100% qualified business purposes, you can still gain a 100% deduction no matter how many hours flown. A short trip still counts.

Unlike acquiring a bulldozer or machinery, a private jet may invite temptation for use in entertainment, leisure, or non-business purposes. With a standard depreciation model, an owner would have to fight temptation and be very careful using the asset for qualified business purposes. However, in following years, a taxpayer would not need 100% business use to remain qualified for the initial 100% deduction. Qualified business use in following years must exceed 50% of usage and other annual requirements must be satisfied. By capitalizing on bonus depreciation in 2022, the asset could be used more freely in subsequent years.

How to Take Advantage of Bonus Depreciation?

To take advantage of bonus depreciation, you need to work with qualified aircraft tax consultants and Acquisitions & Sales teams. The ability to offset business income is limited to those costs associated with business travel, not personal travel. The determination of these costs and imputed income amounts requires that the aircraft owner maintains complete records of each flight, which detail the flight hours logged, the distance between destinations and the number and intent of the passengers for each flight. With the Jet Linx Aircraft Management program, detailed recordkeeping is easily accomplished through our internal team of accounting and finance experts.

Our Aircraft Acquisitions Specialists understand each client’s unique reasoning for purchasing a private jet and can help you choose a tax structure that appropriately addresses your specific needs and circumstances. Our team of experts can also identify the most advantageous legal entities to hold the aircraft ownership interest. No matter what, Jet Linx always recommends speaking with an aviation tax consultant to gain the best possible professional opinion, and we have trusted partners within the industry to help in this process.

After working with Jet Linx to acquire an aircraft, our Aircraft Management program provides further optimization of the asset. With volume discounts on fuel, maintenance, pilot training and insurance, plus guaranteed revenue hours driven by demand from Jet Card clients – our model works to offer the lowest possible operating expenses for aircraft owners. If you ever decide to sell, our Complete Aircraft Transaction program offers assistance in marketing, selling, negotiating and releasing the asset.

Whole aircraft ownership offers a competitive edge in business, but before purchasing a private jet it’s necessary to examine the potential tax impacts it may have on you and your business, and whether those would produce your desired outcomes.

Contact Jet Linx today to reap the full benefits of 100% bonus depreciation and the nation’s best aircraft management solution.

Related Stories

Top 25 Travel Destinations for Flying Private: 6-10

Discover the destinations Jet Linx can take our Aircraft Owners and Jet Card Members around the world.

READ MORE

Top 25 Travel Destinations for Flying Private: 1-5

Discover the destinations Jet Linx can take our Aircraft Owners and Jet Card Members around the world.

READ MORE

Jet Linx Aircraft Management: Buying Power

Jet Linx transforms purchasing scale and tech-optimized analysis of pricing, planning and tankering decisions across our nationwide operations into fuel savings our Aircraft Owners.

READ MORE

Related Stories

Top 25 Travel Destinations for Flying Private: 6-10

Discover the destinations Jet Linx can take our Aircraft Owners and Jet Card Members around the world.

READ MORE

Top 25 Travel Destinations for Flying Private: 1-5

Discover the destinations Jet Linx can take our Aircraft Owners and Jet Card Members around the world.

READ MORE

Jet Linx Aircraft Management: Buying Power

Jet Linx transforms purchasing scale and tech-optimized analysis of pricing, planning and tankering decisions across our nationwide operations into fuel savings our Aircraft Owners.

READ MORE

Contact Us